The global modular chiller market, valued at $2,667.1 million in 2019, is projected to reach $3,698.0 million by 2027, growing at a CAGR of 6.2% from 2020 to 2027. Modular chillers, integral to HVAC systems, are widely used in residential, commercial, and industrial settings for both cooling and heating applications. These systems, comprising components like compressors, evaporators, and chilling towers, are favored for their robustness, redundancy, capacity control, lightweight design, and energy efficiency. Available in air-cooled and water-cooled variants, they cater primarily to commercial and industrial sectors.

The market’s growth is driven by increased construction activities and government investments in infrastructure globally. For example, the Australian government plans to invest $110 billion in transport infrastructure by 2030, boosting demand for HVAC systems, including modular chillers. Similarly, in October 2020, Germany allocated $603.4 million to upgrade HVAC systems in public buildings, further fueling market expansion. Rising disposable incomes in emerging economies, such as a 7% increase in the U.S. from 2017 to 2019, also contribute to market growth by increasing demand for advanced cooling solutions.

Urbanization and industrialization in countries like China, India, Vietnam, and Indonesia are significant growth catalysts. India’s National Smart Cities Mission, aiming to develop 100 smart cities by 2025, and China’s aviation sector, which added 27 new airports between 2014 and 2017, have heightened the need for modular chillers to maintain cool environments. Additionally, industries such as food and beverages, medical, and mining are increasingly adopting these systems, further driving market demand.

However, challenges such as high installation, setup, and maintenance costs, along with fluctuating raw material prices, may hinder growth. Compliance with environmental standards, such as ISO building codes, adds complexity to installations. Despite these obstacles, government initiatives promoting energy efficiency in sectors like power, mining, and automotive present lucrative opportunities for market players during the forecast period.

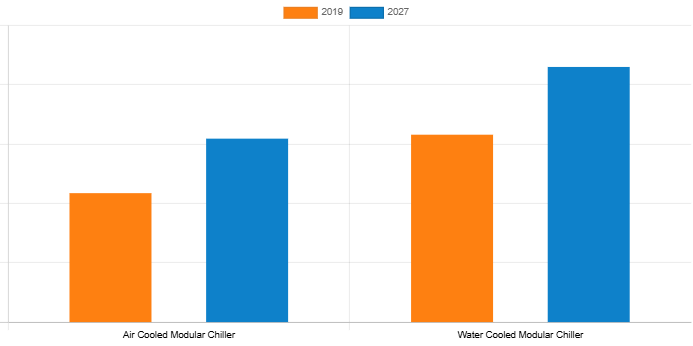

The market is segmented by product type, capacity, application, and region. Water-cooled modular chillers led in revenue in 2019, while the air-cooled segment is expected to grow at a significant CAGR. By capacity, chillers exceeding 300 tons dominated in 2019, reflecting their widespread use in large-scale applications. The commercial application segment held the largest share in 2019, driven by demand in offices, retail, and hospitality sectors. Regionally, Asia-Pacific was the top contributor in 2019 and is expected to maintain its dominance, fueled by rapid urbanization and infrastructure development in countries like China and India.

Key players, including Johnson Controls International Inc., Carrier Corporation, Trane Technologies Plc, Daikin Industries Ltd., and Mitsubishi Electric Corporation, are focusing on strategies like product launches and acquisitions. For instance, Ingersoll Rand’s 2018 acquisition of ICS Cool Energy Ltd. aimed to expand its energy-efficient chiller offerings in Europe. These efforts enhance product portfolios and strengthen market positions.

The report offers a comprehensive analysis of trends, competitive dynamics, and regional opportunities, providing stakeholders with insights into the modular chiller market’s trajectory through 2027. With growing demand and strategic advancements, the market is poised for steady growth, despite challenges.