"Executive Summary Digital Lending Platform Market :

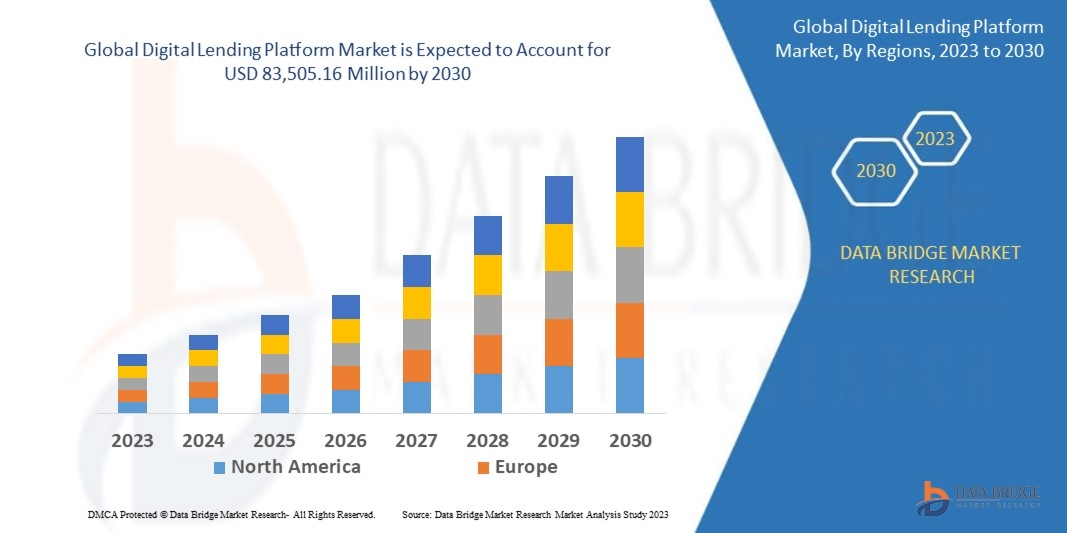

Data Bridge Market Research analyses that the global digital lending platform market which was USD 20,215.23 million in 2022, is expected to reach USD 83,505.16 million by 2030, and is expected to undergo a CAGR of 19.4% during the forecast period of 2023 to 2030.

The data collected to structure a large scale Digital Lending Platform Market report is based on the data collection modules with large sample sizes. This market analysis report also includes CAGR value fluctuations with respect to rise or fall for the certain forecast period. The key highlights of this market report are key market dynamics, current market scenario and future prospects of the sector. Furthermore, emerging product trends, major drivers, challenges and opportunities in the market are recognized and analysed factually while generating this report. With the exploitation of well established tools and techniques in the winning Digital Lending Platform Market report, complex market insights are turned into simpler version.

Digital Lending Platform Market research report studies across-the-board evaluation of the market growth predictions and restrictions. The competitor strategies range from new product launches, expansions, agreements, joint ventures, partnerships, to acquisitions. This industry report comprises of a deep knowledge and information on what the market’s definition, classifications, applications, and engagements are and also explains the drivers and restraints of the market which is derived from SWOT analysis. Global market research analysis report serves a lot for business and bestows with solution for the toughest business questions. While formulating a reliable Digital Lending Platform Market report, research and analysis has been carried out with one step or the combination of several steps depending upon the business and client necessities.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Digital Lending Platform Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-digital-lending-platform-market

Digital Lending Platform Market Overview

**Segments**

- By Component: Software, Services

- By Deployment Type: On-Premises, Cloud

- By End-User: Banks, Credit Unions, Financial Institutions, Peer-to-Peer Lending, Others

The global digital lending platform market is segmented based on components, deployment types, and end-users. In terms of components, the market is divided into software and services. Software solutions are essential for managing and automating the lending process, while services include implementation, training, and support services. On the other hand, the deployment type segment consists of on-premises and cloud-based solutions. Cloud-based deployment offers scalability, flexibility, and cost-effectiveness to financial institutions. Finally, the end-user segment includes banks, credit unions, financial institutions, peer-to-peer lending platforms, and others. Each end-user category has specific requirements and demands for digital lending platforms, catering to their unique business models and customer needs.

**Market Players**

- Fiserv Inc.

- Newgen Software Technologies Limited

- Roostify

- Sigma Infosolutions

- CU Direct

- Finastra

- Sageworks, Inc.

- Math Corporation

- Tavant Technologies

- Pegasystems Inc.

Key market players in the global digital lending platform market include Fiserv Inc., Newgen Software Technologies Limited, Roostify, Sigma Infosolutions, CU Direct, Finastra, Sageworks, Inc., Math Corporation, Tavant Technologies, and Pegasystems Inc. These companies are actively involved in product development, partnerships, and acquisitions to enhance their market presence and expand their customer base. By offering innovative digital lending solutions, these players aim to streamline lending processes, improve customer experience, and drive operational efficiency in financial institutions.

The global digital lending platform market is experiencing significant growth and transformation driven by the increasing adoption of digital technologies in the financial services industry. One key trend shaping the market is the shift towards cloud-based deployment models. Cloud-based digital lending platforms offer various benefits such as scalability, flexibility, and reduced operational costs for financial institutions. These platforms enable lenders to streamline their operations, improve data security, and enhance collaboration among various stakeholders involved in the lending process.

Moreover, the rise of peer-to-peer lending platforms is also contributing to the growth of the digital lending market. Peer-to-peer lending platforms connect borrowers directly with lenders through online platforms, bypassing traditional financial institutions. This model offers borrowers faster access to loans and potentially lower interest rates, while providing lenders with new investment opportunities. As the demand for alternative lending options continues to increase, peer-to-peer lending platforms are expected to play a significant role in shaping the digital lending landscape.

Another key factor driving market growth is the increasing focus on customer experience and personalization in lending services. Digital lending platforms are enabling financial institutions to offer personalized loan products, streamline application processes, and provide real-time support to borrowers. By leveraging data analytics and artificial intelligence, lenders can assess creditworthiness more accurately, tailor loan offers to individual needs, and deliver a seamless borrowing experience. This emphasis on customer-centricity is crucial for financial institutions to stay competitive in a rapidly evolving market landscape.

Furthermore, regulatory developments and compliance requirements are shaping the digital lending platform market. As the regulatory landscape continues to evolve, financial institutions are under pressure to ensure compliance with data protection, consumer privacy, and anti-money laundering regulations. Digital lending platforms that offer robust security features, encryption protocols, and compliance tools are gaining traction among lenders looking to mitigate regulatory risks and safeguard sensitive customer information.

In conclusion, the global digital lending platform market is witnessing significant growth driven by technological advancements, changing consumer preferences, and regulatory dynamics. As financial institutions embrace digital transformation to stay ahead of the competition, the demand for innovative lending solutions is expected to rise. Market players are focusing on product development, strategic partnerships, and customer-centric approaches to capitalize on emerging opportunities in the digital lending space. By continuously evolving and adapting to market trends, companies in this sector can position themselves for long-term success and sustainable growth in the increasingly digital and data-driven lending landscape.The global digital lending platform market is highly competitive, with key players such as Fiserv Inc., Newgen Software Technologies Limited, and Roostify leading the market through innovation and strategic collaborations. These companies are investing in research and development to enhance their product offerings and cater to the evolving needs of financial institutions across the globe. By focusing on improving operational efficiency, customer experience, and regulatory compliance, market players are positioning themselves as leaders in the digital lending space.

One of the key trends impacting the digital lending platform market is the increasing adoption of cloud-based deployment models. Cloud solutions offer scalability, flexibility, and cost-effectiveness, making them an attractive option for financial institutions looking to modernize their lending processes. Moreover, cloud-based platforms facilitate easier integration with existing systems, data security, and collaboration among stakeholders, driving the market growth further.

Another significant trend shaping the market is the rise of peer-to-peer lending platforms. These platforms are disrupting traditional lending models by connecting borrowers directly with lenders, offering quicker access to funds and more competitive interest rates. As consumers seek alternative lending options, peer-to-peer platforms are gaining prominence, challenging traditional financial institutions to adapt their strategies to remain competitive in the market.

Furthermore, the focus on customer experience and personalization is a crucial factor driving the growth of the digital lending platform market. By leveraging data analytics and artificial intelligence, lenders can offer personalized loan products, streamline application processes, and provide real-time support to borrowers. This customer-centric approach not only enhances customer satisfaction but also helps lenders make informed decisions, reduce risks, and improve operational efficiency in the lending process.

Regulatory compliance also plays a vital role in shaping the digital lending platform market. With evolving regulations around data protection, consumer privacy, and anti-money laundering, financial institutions are under pressure to ensure compliance while delivering seamless lending experiences. Digital lending platforms that prioritize security features, encryption protocols, and compliance tools are becoming increasingly popular among lenders seeking to mitigate risks and uphold regulatory standards in their operations.

In conclusion, the global digital lending platform market is undergoing significant transformation driven by technological advancements, changing consumer preferences, and regulatory requirements. Market players are focusing on innovation, strategic partnerships, and customer-centric approaches to capitalize on emerging opportunities in the market. As the demand for digital lending solutions continues to rise, companies that prioritize agility, adaptability, and customer satisfaction are likely to succeed in this competitive landscape.

The Digital Lending Platform Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-digital-lending-platform-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The investment made in the study would provide you access to information such as:

- Digital Lending Platform Market [Global Digital Lending Platform Market – Broken-down into regions]

- Regional level split [North America, Europe, Asia Pacific, South America, Middle East & Africa]

- Country wise Market Size Split [of important countries with major Digital Lending Platform Market share]

- Market Share and Revenue/Sales by leading players

- Market Trends – Emerging Technologies/products/start-ups, PESTEL Analysis, SWOT Analysis, Porter's Five Forces, etc.

- Market Size)

- Market Size by application/industry verticals

- Market Projections/Forecast

Browse More Reports:

U.S. Artificial Sweeteners Market

Global Brushed Direct Current (DC) Motor Market

Europe Departmental Picture Archiving Communication System (PACS) Market

North America GDPR Services Market

Global Ruminants Feed Enzymes Market

Global Healthcare Generative AI Market

Global Aluminium ROPP (Roll on Pilfer Proof) Closures Market

Asia-Pacific Leather Goods Market

Global Boysenberry Market

Global Batter and Breader Premixes Market

North America Prebiotics for Infant Formula Market

Global Oil Dressings Market

Vietnam Interventional Cardiology Market

Europe Skin Packaging for Fresh Meat Market

Global Concrete Canvas Market

North America RF Over the Fiber 5G Market

Global Preterm Birth and Premature Rupture of Membranes (PROM) Testing Market

Europe Veterinary In Vitro Fertilization (IVF) Market

Global Vesicoureteral Reflux Market

North America Hyperspectral Imaging Systems Market

Global Body Protection Equipment Market

North America Optical Fiber Monitoring Market

Global Gas Chromatography Food Testing Market

Middle East and Africa Flare Monitoring Market

Global Injectable Targeted Therapy Market

Global Artificial Intelligence (AI) Chipset Market

Global Computer Keyboard Market

Global Squash Rackets Market

Global Vacuum-Assisted Biopsy Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com